Disability Employment Incentive Act

Disability Employment Incentive Act

Synopsis:

S. 255 would increase three tax benefits available to businesses that hire individuals with disabilities and make their premises more accessible. It would widen eligibility for the Work Opportunity Tax Credit, available to employers who hire individuals from groups facing high rates of unemployment, by adding Social Security Disability Insurance recipients to a list that also includes Supplemental Security Income or Temporary Assistance for Needy Families recipients, Supplemental Nutrition Assistance Program enrollees and vocational rehabilitation referrals. It would also expand the tax credit, which businesses can currently claim only for first-year employees, to include second-year employees. In addition, S. 255 would change the Disabled Access Credit, which offsets some accessibility-related renovation costs, to cover more expensive projects and apply to more businesses.

Supporters:

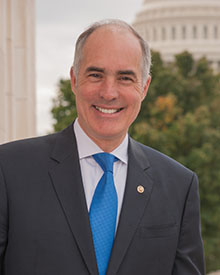

Sens. Casey (D-Pa.), Duckworth (D-Ill.), Murray (D-Wash.), Van Hollen (D-Md.), Hassan (D-N.H.), Klobuchar (D-Minn.); American Association of People with Disabilities, American Network of Community Options and Resources, Autism Society, Christopher & Dana Reeve Foundation, The Arc, Paralyzed Veterans of America.

Opponents:

None reported.

Links to Additional Resources:

This entry was posted in and tagged Bob Casey, disability employment, Employment & Life Skills, S. 255, S255, taxation, U.S. Congress.